Author | |Eastland

On November 25th, 2023, Changan Automobile (000625.SZ) and Huawei signed the Memorandum of Investment Cooperation. According to the memorandum, Huawei (Party A) and Changan Automobile (Party B) will set up target companies, and the shareholding ratio of Party B shall not exceed 40%.

The business scope of the target company includes smart driving solutions, smart cockpit, smart car digital platform, intelligent cloud car, smart car lights, AR-HUD, etc. Excluding "Three Electricity", this part of the business remains in Huawei Digital Energy.

Huawei splits automobile BU.

Huawei BU was born in 2019. After several years of exploration, the strategy of "platform+ecology" was determined, with the aim of providing digital pedestals and development tools for smart cars.

Since its establishment, the course of BU, a smart car solution (referred to as "Huawei Smart Drive" for short), can be summarized as three "3s": it spent $3 billion, had 300 customers and built three platforms (smart car digital platform, intelligent driving computing platform and HarmonyOS intelligent cockpit platform).

Huawei and Changan Automobile promise to carry out long-term cooperation and strategic coordination with the target company. In principle, part of the business scope and solutions are provided by the target company for vehicle customers.Huawei does not participate in competition..

The target company will gradually open its equity to existing and potential car enterprise partners and become a diversified equity company.

The memorandum has three main points:

First, BU, a smart car solution, was "integrated" into the new company, completely ending Huawei’s internal discussion on building cars.# Sweep the floor #

Second, Huawei will realize the investment income through the target company, stay away from the involution of the automobile industry, and be in a detached position.

Third, the target company is controlled by Changan Automobile and Huawei.

Why did you choose Changan Automobile?

a starved camel is still bigger than a horse—when the mighty fall

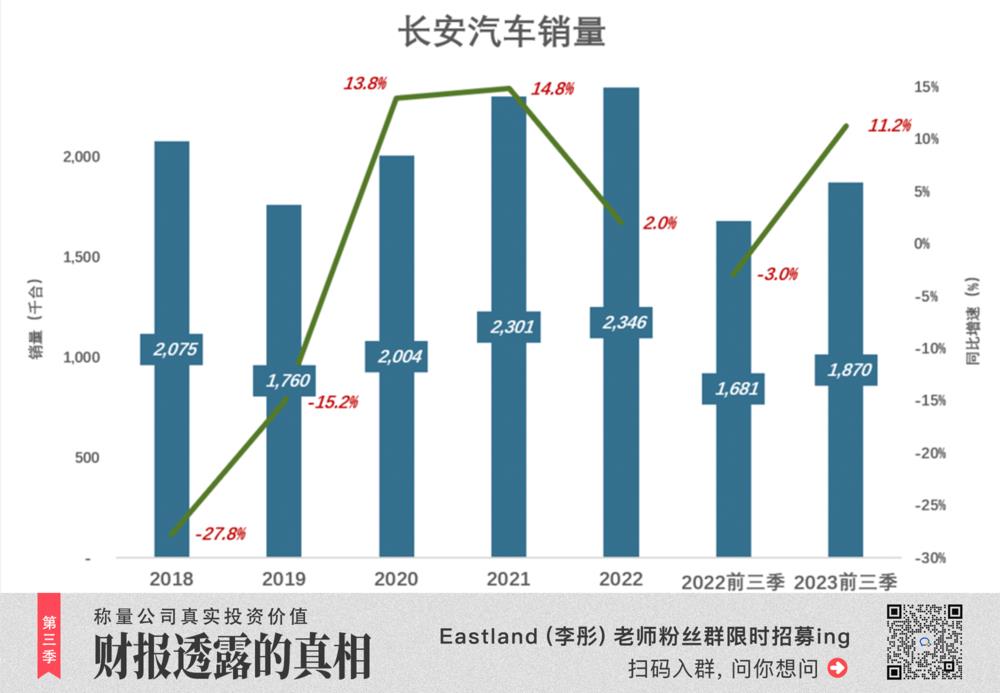

In 2016, after the sales volume of Changan Automobile surged to 3.06 million units, it began to decline;

In 2017, it decreased by 6.2% to 2.87 million units;

In 2018, it fell 27.8% to 2.14 million units;

In 2019, it fell to the bottom with a sales volume of 1.76 million units.

The main reason for this round of plunge is the "cliff-like" decline in Changan Ford’s sales:

In 2016, the sales volume reached 940,000 vehicles, accounting for 30.8% of the total sales volume; Less than 180,000 vehicles in 2018. Since then, the joint venture brand has rebounded but failed to regain its former glory. In 2022, it sold 250,000 vehicles, accounting for 10.7% of the total sales.

In 2020, Changan Automobile sales began to slowly pick up; In 2022, the sales volume was 2.35 million vehicles, which was about 77% of the peak in 2016.

In the first three quarters of 2023, Changan Automobile sold 1.87 million vehicles, up 11.2% year-on-year.

In the first three quarters of 2016, Changan Automobile sold 2.2 million vehicles. Sales in the first three quarters of 2023 were equivalent to 85% in the same period of 2016.

In any case, Changan Automobile is also an enterprise with an annual sales volume of more than 3 million vehicles, and few car companies in China have reached this "stage". # See the world #

Independent brand takes the lead

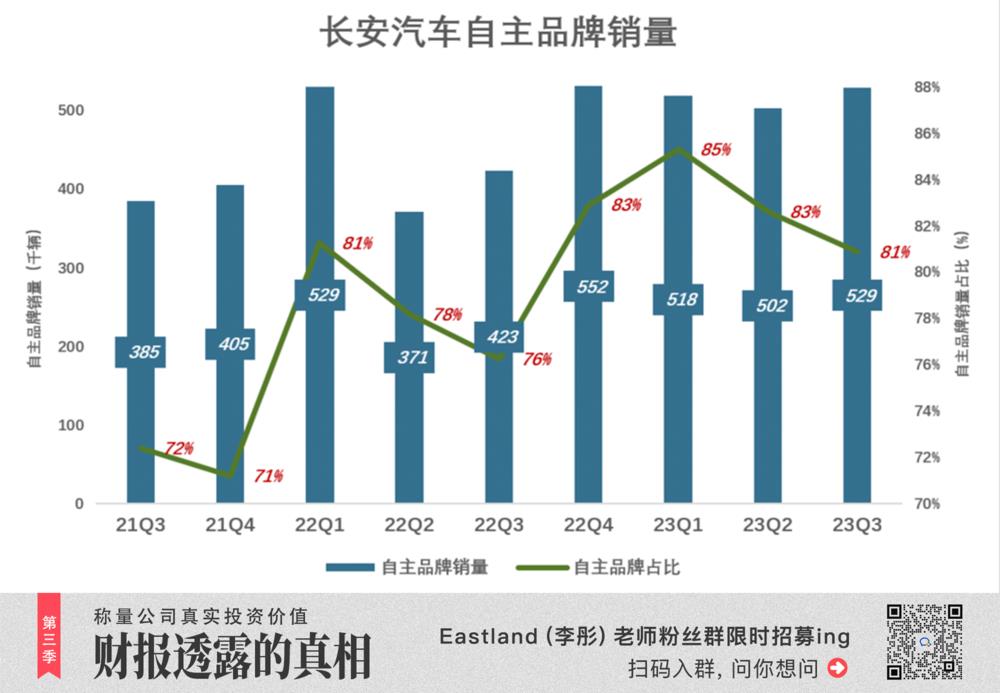

After the decline of joint venture brands, the proportion of independent brands in total sales increased steadily.

In Q3 of 2021, the sales volume of independent brands was 385,000, accounting for 72% of the total sales volume;

In Q3 of 2022, the sales volume of independent brands was 423,000 vehicles, accounting for 76% of the total sales volume.

In Q3 of 2023, the sales volume of independent brands was 529,000, accounting for 81% of the total sales volume.

In 2022, the sales volume of Changan’s own brands reached 1.875 million, up 6.8% year-on-year, and the scale reached a new high. The total sales volume of the joint venture brand is 470,000 vehicles, accounting for 20% of the total sales volume.

In the first three quarters of 2023, the sales volume of independent brands was 1.55 million units, a year-on-year increase of 17.1%.

In the first three quarters of 2016, the sales of two joint venture brands, Ford and Mazda, accounted for 36.2% of the total sales of Changan Automobile.

In the first three quarters of 2023, this ratio was only 11.8%.

From January to September, 2023, the sales volume of two joint venture brands, SAIC Volkswagen and GM, accounted for 46.1%; The sales of Guangqi Honda and Toyota, two joint venture brands, accounted for as much as 62.5%.

Independent brands provoke the girders, and Changan Automobile takes the initiative. In-depth cooperation and resource mobilization with Huawei are less likely to be constrained internally.

New energy vehicle slow half beat

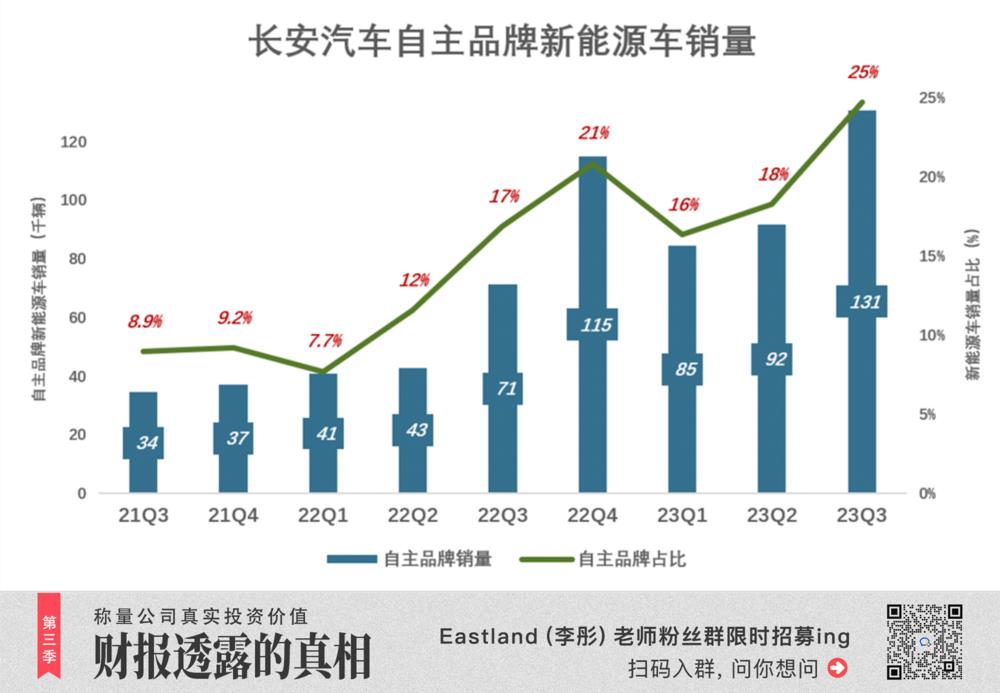

Changan Automobile’s new energy vehicles started slowly. In Q3 of 2021, the sales volume of new energy vehicles with independent brands was 34,000, accounting for 8.9% of the sales volume of independent brands.

It was not until the end of 2022 that Changan Automobile began to exert its strength. The sales volume of Q4 new energy vehicles reached 115,000, a year-on-year increase of 209%.

In the first three quarters of 2023, the total sales volume of new energy vehicles reached 307,000, accounting for 25% of the total sales volume of independent brands.

In 2022, Changan Automobile sold 271,000 independent new energy vehicles. Due to the low base, the year-on-year growth rate reached 155%, and the 2022 Annual Report declared that "the year-on-year growth rate was significantly better than the broader market" (the national new energy vehicle sales increased by more than 90% year-on-year).

In 2022, the penetration rate of new energy vehicles in China market has reached 25.6%. Changan new energy vehicles only account for 11.6% of the total sales, accounting for 14.5% of the sales of independent brands, far behind the market.

In the first three quarters of 2023, the sales volume of Changan’s own brand new energy vehicles was 307,000, up 135% year-on-year, accounting for 19.8% of the sales volume of its own brand, 10 percentage points behind the market (the national penetration rate in the first three quarters was 29.8%).

In Q3 of 2023, this proportion climbed to 24.7%. According to this progress, the proportion of new energy vehicles in Changan can catch up with the market in 2024.

In 2017, Changan Automobile and Weilai reached a strategic cooperation. In 2018, Changan and Weilai formally established a joint venture company. No substantial progress was made in the following years.

In 2021, the joint venture company changed its name to Aouita Science and Technology, introduced Contemporary Amperex Technology Co., Limited, signed a contract with Huawei, and established the "CHN" model (Chang ‘an, Huawei, Ningde). In October 2023, Aouita 11 sold 3,888 vehicles. Aouita 12 has accumulated more than 10,000 vehicles.

"Deep Blue" is another important new energy brand of Changan Automobile. From January to October 2023, the cumulative sales volume was 97,000 vehicles, of which the sales volume in October reached 15,000 vehicles.

In October 2023, the sales volume of new energy vehicles under Changan reached 57,400. In addition to Aouita and Deep Blue, there are also models such as Lumin (Miniature), UNI-V (Compact) and CS75 (Compact SUV).

Generally speaking, Changan’s new energy vehicles have many business ideas, many models, low sales volume, and the penetration rate underperforms the broader market.

If you are poor, you will think about it. Changan Automobile lags behind in the first half, binding Huawei and striving to overtake in the second half. Why not?

"Two hurdles" of the new company

In the past four years, Huawei has made great achievements in the field of smart driving, but there are two insurmountable obstacles.

The first hurdle: R&D, production, sales, profit and cash flow form a closed loop.

In the past ten years, Huawei has invested a total of 977.3 billion in R&D, and invested 161.5 billion in 2022 alone. Since the establishment of BU, a smart car solution, it has invested a total of 3 billion US dollars, of which 70%-80% has been invested in smart driving research and development (Yu Chengdong revealed). Based on 16 billion yuan,Huawei’s R&D investment for three years is only 10% of Huawei’s total R&D investment in 2022!

In 2022, the revenue and expenditure of Huawei’s smart driving business were 2.1 billion and 13.5 billion respectively, which was the only business of Huawei that lost money.

In contrast, Tesla and BYD have invested far more in R&D than Huawei Zhijia, and have established a closed loop of automobile R&D, production and sales:

In the first three quarters of 2023, the R&D investment of Tesla and BYD was 20.6 billion (US$ 2.88 billion) and 24.9 billion respectively, 25% more than that of Huawei’s three-year investment!

In the first three quarters of 2023, Tesla’s net profit was 7.03 billion US dollars, down 20.8% year-on-year; BYD’s net profit was 21.37 billion, a year-on-year increase of 129.5%;

In the first three quarters of 2023, Tesla’s net cash flow from operating activities was 63.7 billion (US$ 8.89 billion); BYD’s net cash flow from operating activities reached 97.86 billion (140.8 billion in 2022).

Huawei’s R&D investment in smart driving is even less than that of Baidu.

According to public information, since Baidu established the Intelligent Driving Group (IDG) and launched Apollo, the annual R&D investment has exceeded 10 billion.

Huawei has always paid attention to cash return, and all its businesses have achieved closed-loop research and development, profit and cash flow. In August 2022, Ren Zhengfei named the car BU-"Smart car solutions cannot spread a complete front, and it is necessary to reduce the research budget and strengthen the business closed loop."

The smart driving business is integrated into the new company, and the primary purpose is to "stop bleeding".

In addition to equity financing and debt financing (Changan Automobile can provide guarantee), the new company’s R&D funds must be earned by itself. You get what you pay for every penny, and you don’t guarantee 20 billion R&D investment every year. Why should you stay at the "poker table"?

The second hurdle: optimizing intelligent driving requires a lot of data.

The path of developing autonomous driving is similar, but it is by no means a simple software development. The key is to use machine learning and deep learning technology to continuously optimize the algorithm and model and improve the performance of the automatic driving system, which requires a lot of data.

It is the same as face recognition. People’s modeling is not so good. Training and perfecting with 200 million pictures is definitely better than training with 2 million pictures.

The most ideal way is to let thousands of vehicles equipped with automatic driving system run on the road, and use the operation of human drivers to "train" the automatic driving system, such as when to slow down, what conditions can be combined and when to brake, so that the system decision-making is closer and closer to human beings.

Baidu’s shortcoming is the lack of brand appeal. It can only buy a car, install it and test it by itself. By 2023, the cumulative mileage of autonomous driving test will be 40 million kilometers.

Huawei, on the other hand, can get the driving data of 1 billion kilometers only from the industry (the cumulative sales volume of M5 has reached 120,000 vehicles, assuming that each vehicle runs 10,000 kilometers every year).

Poor Baidu invested more manpower, material resources and time than Huawei’s intelligent driving BU, but it soon fell behind (at least in the public and investors’ perception).

The lack of data sources to improve artificial intelligence driving is the root cause of Apple’s delay in leaving. Apple is not short of talents and money. What it lacks is a million smart cars on the road.

Huawei’s catch-up goal is obviously not Baidu but Tesla.Tesla has 4 million vehicles in the world, and it is still increasing at the rate of 2 million vehicles per year.

BYD will sell 1 million smart cars in 2024, which is second only to Tesla.

Huawei’s smart driving needs millions of smart driving vehicles on the road to stay at the "card table".

Lack of money and insufficient data, Huawei’s smart driving BU can’t cross these two hurdles.Holding hands with Changan Automobile did not solve the problem, but just passed the problem on to the joint venture company.

Joint venture with Chang ‘an is the winner of Huawei’s "building a car"

The fundamental way to solve the problem is to sell more cars, sell smart cars, withdraw funds and obtain valuable data.

There are three modes of cooperation between Huawei and car companies:

The first mode will not help Huawei collect data;

The second mode (HI mode) is adopted by only one company in Chang ‘an Aouita, which sold 12,000 vehicles in 2022, estimated 30,000 vehicles in 2023 and less than 50,000 vehicles in two years.

There are four partners who adopt the third mode (HarmonyOS Zhixing), such as Cyrus, Jianghuai, Chery and BAIC, and it is not difficult to further "expand".

In 2024, the sales of existing partners will be between 500,000 and 1 million. The growth rate is not fast enough, which may delay the fighters.

There are three advantages to establishing a joint venture with Chang ‘an:

The first is the return on investment. Huawei injects tangible and intangible assets of Zhijia BU into the new company. If the future joint venture company is valued at 100 billion yuan, the value of Huawei’s equity is about 60 billion yuan; If the valuation is 200 billion, Huawei holds 120 billion shares.

The second is to tap the potential of Changan Automobile. "The lean camel is bigger than the horse", after all, it once reached the scale of annual sales of 3 million vehicles, and it is worth looking forward to the future sales of smart driving new energy vehicles exceeding 1 million vehicles. The highest sales volume of Xiaokang (predecessor of Cyrus) and Jianghuai in history add up to less than one-third of that of Chang ‘an. Get a 40% stake and trade. Only in this way will Changan Automobile devote itself to the joint venture company.

The third is to facilitate cooperation with domestic joint venture car companies, and then explore overseas markets.

Existing partners Cyrus, JAC, BAIC and Chery can participate in shares, but it is impossible to be on an equal footing with Changan. One monk carries water to eat, three monks have no water to eat, and the new company has to rely on Changan to carry water.

The equity of the new company is "gradually open", which depends not only on the face of the owner (Huawei) but also on the mood of the shopkeeper (Chang ‘an).Sellers can’t figure it out.

Holding hands with Chang ‘an is the winner of Huawei’s smart driving. The key depends on whether the new energy vehicles of the joint venture company can sell well.

* The above analysis is for reference only and does not constitute any investment advice!

关于作者